cayman islands tax residency certificate

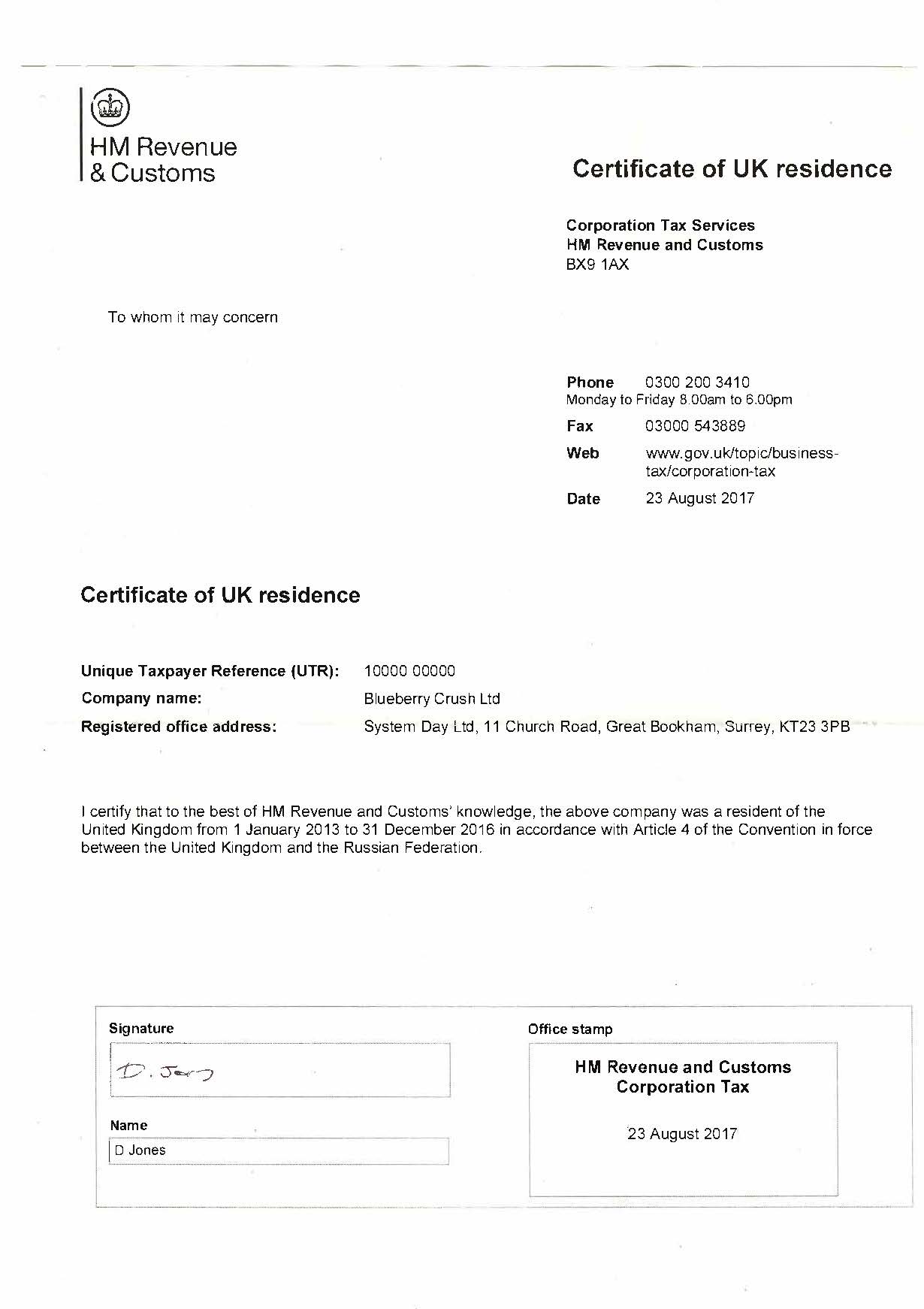

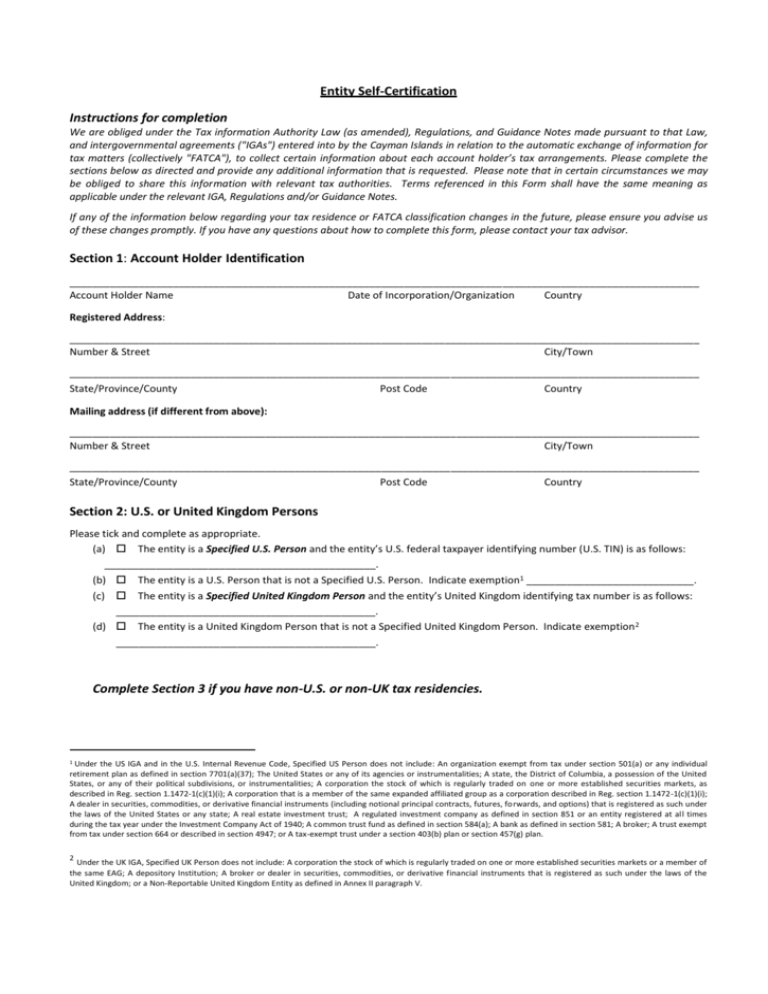

Entity Self-Certification Instructions for completion We are obliged under the Tax information Authority Law as amended Regulations and Guidance Notes made pursuant to that Law and intergovernmental agreements IGAs entered into by the Cayman Islands in relation to the automatic exchange of information for. When you will out your application for your Cayman Islands Residency Certificate you will pay a 1220 application fee as well as a 6100 activation fee for your residence permit.

Entity Self Certification Form Cayman Islands Department Of

The Residency Certificate for Persons of Independent Means allows investors with high independent incomes to live in the Cayman Islands for up to 25 years with their family.

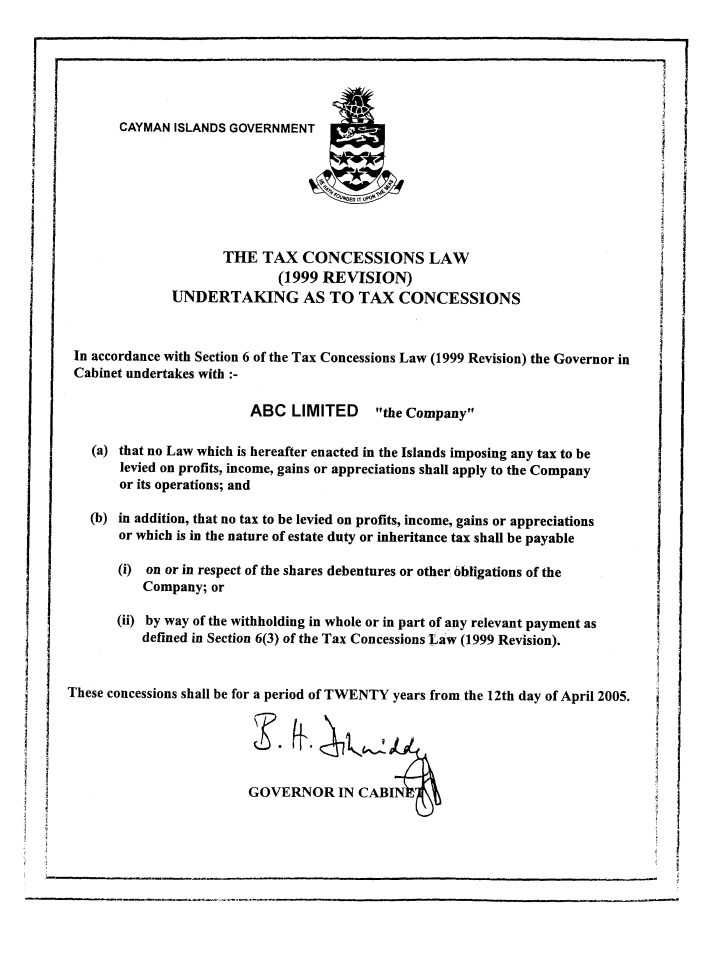

. In particular one can apply to the Director of WORC for a Residency Certificate which is valid for 25 years and is renewable. There is no income tax no property tax and no corporate tax. Residency Certificate for Persons of Independent Means grants the right to live and work.

Applicants who meet the eligibility criteria and are of good character and health will be issued a Residency. To reside in Grand Cayman the person must show proof of an annual. This is a long-term residence category for persons who invest in or who are employed in a senior management capacity within an approved category of business.

This may be relevant or desirable for citizens of European Union EU member states for the purposes of compliance with Reporting of Savings Income Information Law. The Substantial Business Presence Residency Certificate allows the investor to reside in Cayman Islands and work in businesses where he or she has made. Residency Certificate Business Presence The right to reside in the Cayman Islands is available to individuals who either own at least a share in an approved category of business.

You will pay an additional 1200 per dependent and you will also need to pay any annual work permit fees which vary by industry and employment capacity. If the application is approved there is a one-time issue fee of CI100000 US12195122. Back Whether coming to Cayman as an Investor homeowner to set up a local business on a 2 year Global Citizen Concierge Program Certificate GCCP or via a Work Permit there are several options to consider when applying for Residency in the Cayman Islands.

The offshore zone offers very interesting conditions for real estate customers applying for residency on that ground in order. Little Cayman the smallest of the Cayman Islands is well-known for its abundance of wildlife. What are the major benefits of Cayman islands residency.

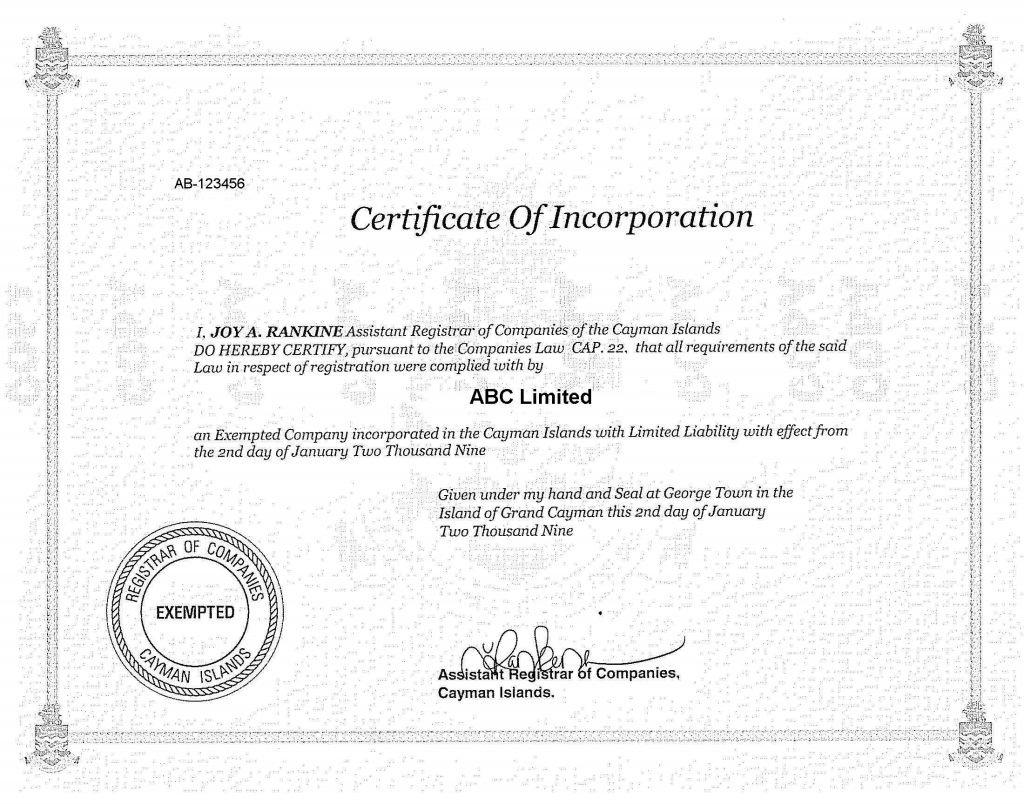

Residency is available by acquiring a Certificate of Direct Investor for those persons who have made or propose to make an investment of at least 1000000 KYD 1220000 USD in a licensed employment generating business or businesses in the Cayman Islands being a business or businesses in which at least 30 of the total number of employees are Caymanians unless. This Certificate is valid for 25 years and is renewable and entitles the holder and any qualifying dependents to reside in the Cayman Islands and work in the business in which they have invested or are employed in a senior management capacity. For foreign nationals not wishing to work in the Cayman Islands but simply wishing to have the right to reside there are alternative options.

The fee to apply for a Certificate of Permanent Residence for Persons of Independent Means is CI500 US60975. Residency Certificate for Persons of Independent Means. Individual - Taxes on personal income.

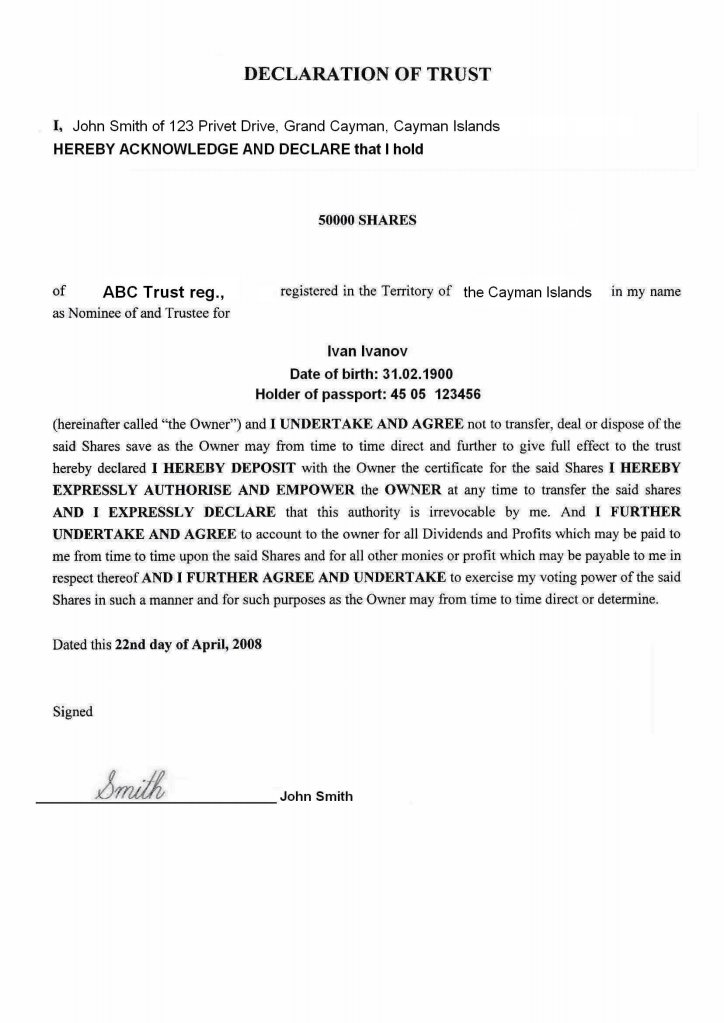

COUNTRYCOUNTRIES OF TAX RESIDENCY TAX REFERENCE NUMBER TYPE TAX REFERENCE NUMBER I hereby confirm that I am for tax purposes resident in the following countries indicate the tax reference number type and number applicable in. Corporate - Corporate residence Last reviewed - 08 December 2021 Since no corporate income capital gains payroll or other direct taxes are currently imposed on corporations in the Cayman Islands corporate residency is not relevant in the context of Cayman Islands taxation. DECLARATION OF TAX RESIDENCY OTHER THAN US Complete section 3 if you have non-US.

Certificate of Permanent Residence for Persons of Independent Means grants the right to live but not work. This Certificate which is valid for 25 years and renewable thereafter entitles the holder and any qualifying dependants to reside in the Cayman Islands without the right to work. The category is open to persons already resident in the Cayman Islands and persons wishing to become resident.

For each dependent there is. When you will out your application for your Cayman Islands Residency Certificate you will pay a 1220 application fee as well as a 6100 activation fee for your residence permit. A Residency Certificate Substantial Business Presence is available to individuals who either own at least a 10 share in an approved category of business or will be employed in a.

Residency Certificate for Persons of Independent Means. There are no corporate income capital gains inheritance. A person who is eighteen years of age or older and who satisfies the requirements set out below may apply to the Chief Immigration Officer for the right to reside in the Cayman Islands as a person of independent means.

If the application is successful the person. If you work outside of the Cayman Islands and your company qualifies to set up an office within a Special Economic. Last updated 15 September 2020.

Residency Certificate - Substantial Business Presence allows business owners andor its senior management to live and work in the Cayman Islands for 25 years. You will pay an additional 1200 per dependent and you will also need to pay any annual work permit fees which vary by industry and employment capacity. With nearly twice as many corporations as residents and a reputation as a major offshore tax haven the Cayman Islands is a popular choice for expats with the financial means to live there.

A benefactor investing in the economy receives a resident certificate which gives him or her the opportunity to live permanently in the Cayman Islands. What is Little Cayman known for. Residency Certificate for Persons of Independent Means.

The Cayman Tax Information Authority can grant tax residency certificates to individuals ordinarily resident in the Cayman Islands. An applicant must invest a minimum of CI1000000 US1219513 of which at least CI500000 US609757 must be in developed. Individuals aged over 18 who meet certain financial requirements and make a significant investment in the Cayman Islands may apply for a Certificate for Persons of Independent Means which provides the right to reside in the Cayman Islands for a.

How To Get Cayman Islands Residency And Pay Zero Tax

Rerc Cayman Fill Online Printable Fillable Blank Pdffiller

Cayman Islands Tax Efficient Residency Visa

How To Get Cayman Islands Residency And Pay Zero Tax

Cayman Islands Residency By Investment Quick Guide Golden Capitalist

كوب من الوحل تنسيق Cayman Islands Work Visa Tafraa Com

Cayman Resident 2021 By Acorn Media Issuu

How To Get Cayman Islands Residency 7th Heaven Properties

The Cayman Islands Residency By Investment Programme Latitude

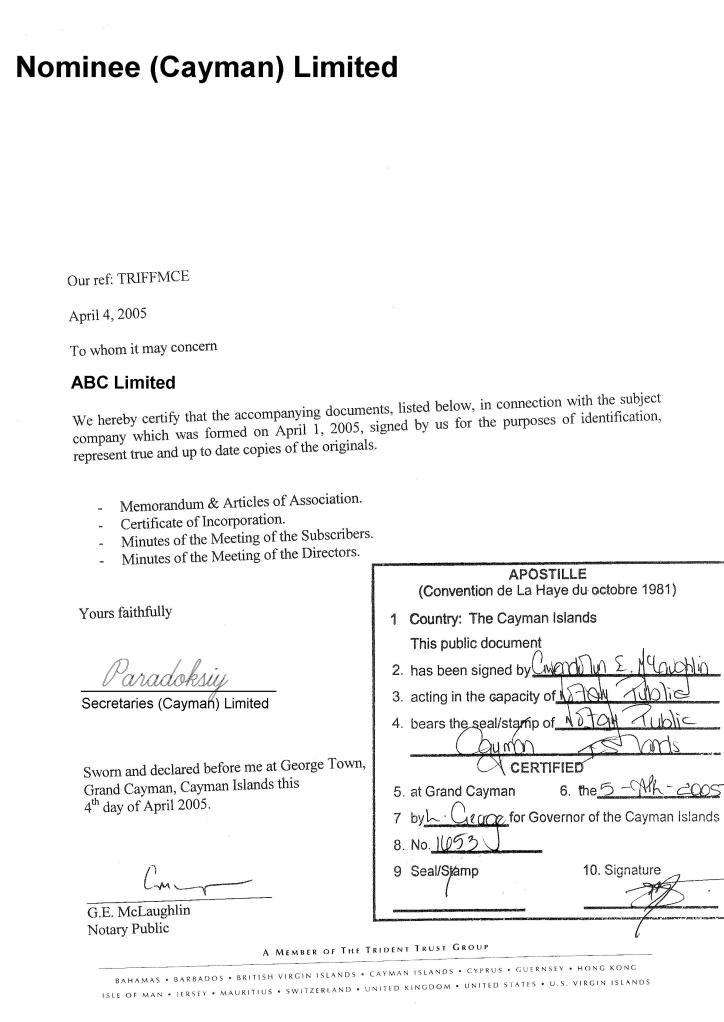

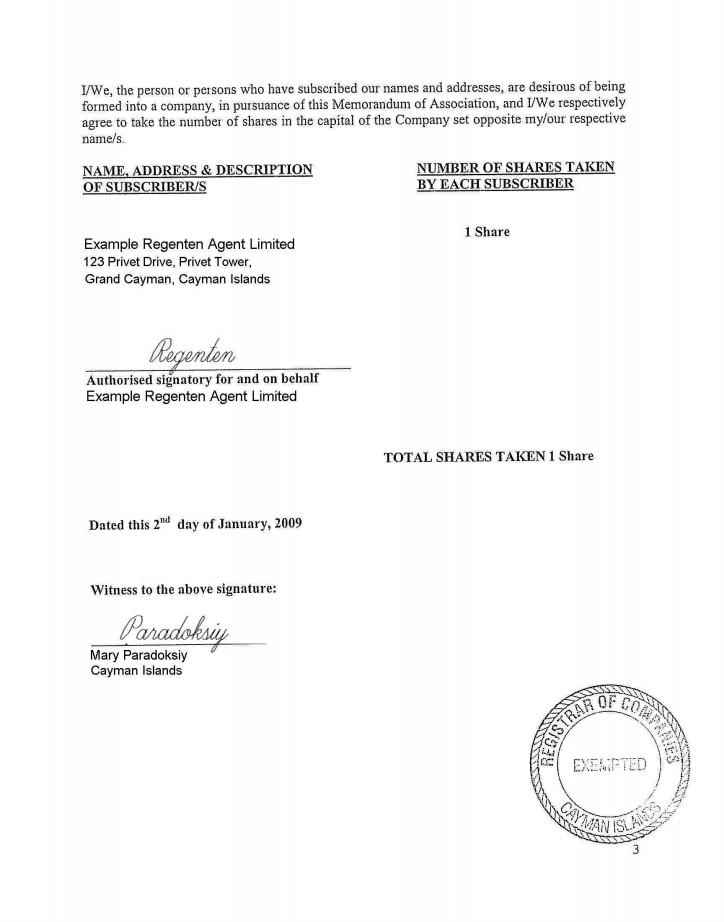

Company Registration In Cayman Islands Business Starting Setup Offshore Zones Gsl

Fillable Online Person Married To A Caymanian Cayman Islands Immigration Bb Fax Email Print Pdffiller

Company Registration In Cayman Islands Business Starting Setup Offshore Zones Gsl

Company Registration In Cayman Islands Business Starting Setup Offshore Zones Gsl

Entity Self Certification Form Cayman Islands Department Of

Company Registration In Cayman Islands Business Starting Setup Offshore Zones Gsl

Company Registration In Cayman Islands Business Starting Setup Offshore Zones Gsl

Company Registration In Cayman Islands Business Starting Setup Offshore Zones Gsl